Goom IRPF

Tramitación del IRPF en Business Central

Qué es Goom IRPF

Goom IRPF es una herramienta integrada en el ERP online Business Central para la automatización de la tramitación del IRPF.

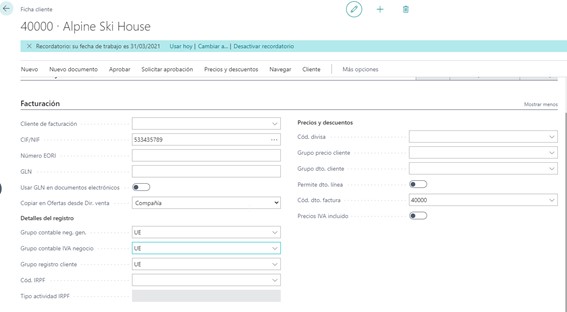

En Goom IRPF es posible configurar diferentes grupos de contabilidad del IRPF para clientes y proveedores. De esta forma, permite calcular, asignar y liquidar de forma automática retenciones del IRPF en operaciones de compra y de venta. Así como generar informes para la preparación y presentación de diferentes declaraciones de retenciones de la AEAT. Trabaja con informes en formato PDF y Excel y con los modelos 111, 190, 115 y 180.

Configuración inicial

En Goom IRPF se puede definir una configuración general del IRPF que determina el asiento de liquidación de las retenciones que luego el usuario podrá realizar automáticamente con la periodicidad que necesite. Es decir, se realiza una configuración inicial para clientes y proveedores.

Claves de retención

Después se configuran las claves de retención que se quieran dar de alta tanto en los registros de facturas de compras como de ventas. Dichas retenciones se establecen tanto para el IRFP de “Actividades profesionales” como de “Arrendamiento de inmuebles”.

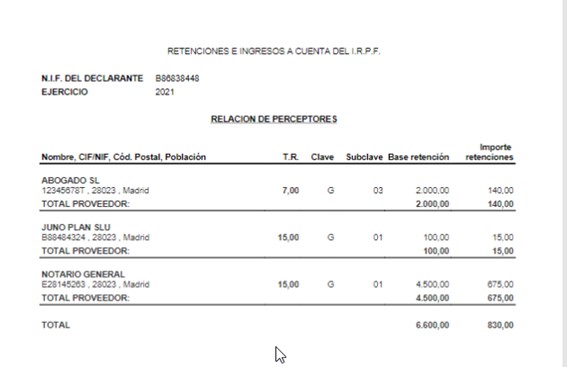

Movimientos de retención y generar informes

Tras la correcta gestión de estas configuraciones se generan movimientos de retención que luego serán utilizados para la obtención de informes.

Descubre Goom IRPF

¿Quieres ver Goom IRPF en acción?

Descubre cómo gestionar el IRPF en Business Central

Beneficios

Es un módulo integrado en Business Central, un ERP líder en el mercado con miles de usuarios en todo el mundo y con actualizaciones periódicas.

Cumple con los requisitos de la Agencia Tributaria.

Permite automatizar la tramitación del IRPF y los modelos 111, 190, 115 y 180.

Genera informes en PDF y Excel y la presentación de las declaraciones de las rentenciones de la AEAT.

Integraciones

Goom IRPF es una solución que se integra de forma nativa en el ERP online Microsoft Business Central (antes Dynamics NAV). Business Central es una solución en la nube con una implantación a escala que ofrece a los negocios un espacio flexible con un crecimiento a medida. Permite la gestión contable, financiera y logística del negocio y, añadiéndole módulos como Goom IRPF, nos permite automatizar la tramitación de los impuestos y obtener una visión global y en tiempo real del estado del negocio.