El Boletín Oficial del Estado ha publicado los detalles para acogerse a la primera fase del Programa «Kit Digital». La iniciativa contempla la subvención de la digitalización de las pymes españolas en el marco del Plan de Recuperación, Transformación y Resiliencia de la Unión Europea.

La disposición 21873 del BOE de 30 de diciembre publica las bases reguladoras del Kit Digital para pymes en la primera convocatoria que será efectiva a principios de 2022 y que irá dirigida a empresas de entre 10 y 49 empleados y autónomos. Se destinará en esta primera fase un presupuesto de 500 millones de euros que pueden beneficiar a un millón de pymes y autónomos del país. El Programa «Kit Digital» destinará en el periodo de 2021-2023 una partida de 3.067 millones de euros para que pymes y autónomos puedan adoptar soluciones digitales en diferentes ámbitos de su actividad.

Plazos y procesos de solicitud de las convocatorias

Las pymes y autónomos solicitantes dispodrán de 3 meses desde la publicación de la convocatoria de la ayuda para su solicitud. O, en su caso, hasta el agotamiento del crédito.

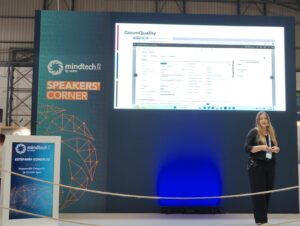

La solicitud de la misma se hará através de Acelera Pyme, el instrumento gubernamental para la gestión de estas ayudas. Pymes y autónomos deberán cumplimentar un est de madurez digital y realizar el proceso con un agente digitalizador como Goom Spain. Los agentes digitalizadores somos empresas especializadas en transformación digital que contamos con la experiencia y requisitos técnicos gubernamentales para implantar las soluciones digitales adoptadas.

Bases reguladoras del Kit Digital para pymes y autónomos

Los requisitos de los beneficiarios publicados en el BOE son los siguientes:

- Disponer de consideración de pequeñas empresa según lo dispuesto en el Anexo I del Reglamento (UE) n.º 651/2014 de la Comisión, de 17 de junio de 2014.

- Tener inscripción en regla en el Censo de empresarios, profesionales y retenedores de la Agencia Estatal de Administración Tributaria o, en su caso, en el equivalente de la Administración Tributaria Foral.

- Que no exista consideración de empresa en crisis.

- Estar al corriente de las obligaciones tributarias y con la Seguridad Social, ni estar sujeto a una orden de recuperación pendiente de la Comisión Europea por ilegalidad o icompatibilidad.