A partir del 11 de octubre de 2021 entra en vigor la prohibición de software de doble uso en el marco de la Ley 11/2021 de prevención del fraude fiscal

La Ley 11/2021 de prevención del fraude establece un nuevo marco sancionador concreto para la fabricación, comercialización y tenencia de sistemas y programas informáticos que permitan modificar y manipular la información contable y de gestión. Esta nueva infracción tributaria para las soluciones digitales que soporten procesos contables, de facturación o de gestión puede afectar a cientos de autónomos y pymes en España que en caso de incumplimiento se enfrentarían a multas de hasta 50.000 euros.

Hacienda estima que el uso por parte de las empresas de programas informáticos que manipulan los registros contables supone unas pérdidas para las arcas públicas de unos 200.000 millones de euros. Con el objetivo de terminar con estas y otras prácticas fraudulentas que repercuten en la recaudación, el pasado mes de julio se aprobaba la Ley 11/2021 con una entrada en vigor progresiva. El 11 de octubre de 2021 lo hacen sus apartados 4 y 21 del artículo decimotercero que regulan la utilización de programas informáticos de contabilidad con la prohibición de software de doble uso.

Esta ley establece una nueva infracción tributaria tipificada como la fabricación, producción y comercialización de sistemas y programas informáticos que permitan manipular la contabilidad. Con este tipo de software algunas empresas modifican sus libros de cuentas para evitar el pago de impuestos. Además de la prohibición expresa de usar este tipo de sistemas informáticos, los programas de contabilidad deberán garantizar la integridad, la conservación, la trazabilidad y la inalterabilidad de los registros de operaciones. Es decir, deberán cumplir determinadas especificaciones técnicas y obtener las certificaciones que garanticen el cumplimiento del nuevo marco legal.

Las multas para autónomos y empresarios abracaría desde los 1.000 euros por la tenencia de este tipo de software de doble uso hasta los 50.000 por año de utilización. Hacienda establecerá un sistema de vigilancia más eficar sobre este tipo de programas y establecerá certificaciones obligatorias.

Sobre el software de doble uso

El software de doble uso son aquellos programas informáticos que permiten manipular la contabildad del negocio. Es decir, permiten ocultar determinados cobros rebajando así la factural fiscal de la empresa. La prohibición de software de doble uso pretende actualizar la legislación de la llevanza digital de la contabilidad que tradicionalmente ha sido manual.

Solución digital para la contabilidad que cumpla con la nueva legislación

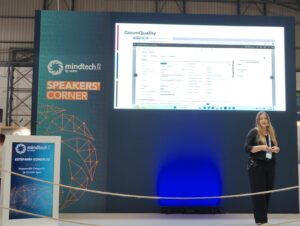

Las empresas deben asegurar el cumplimeinto de la nueva ley a través de un sistema de gestión contable o facturación digital que cumpla con los requisitos técnicos y las certificaciones que pide la Agencia Tributaria. Es decir, que asegure la integridad de los datos contables, la trazabilidad y la inalterabilidad de los mismos.

El ERP online de Microsoft, Business Central, no permite borrar ni cambiar registros contables sin dejar rastro. En el sistema, todo lo relativo a la contabilidad y los registros deja huella. E incluso para aquellos campos que no impliquen un registro contable y, por tanto, puedan ser borrados o modificados, puede establecerse el control a través del log de cambios.